Purchased your favorite dress online, but you must have been scared while entering your credit card details despite being security claimed by shopping platforms. Don’t worry if you have virtual credit cards in India then you can tackle this problem with ease.

Well, in this article from the CROX Times, we are going to explain everything related to Virtual Credit Card in India, how to use Virtual Visa Card in India, etc.

Let’s dive into it

What is a Virtual Credit Card?

A Virtual Credit Card (VCC) is a unique credit number that allows you to transact with the main credit card without revealing its original details. And further you can control your spending limit at the same time and can set an expiry date for the same as well.

How does Virtual Credit Card work?

Most online retailers, right from Amazon to eBay, store their customer’s payment information. It is quite convenient for everyone as they don’t have to enter detail every time. But at the same time, this provides hackers an opportunity to easily access the data if it is not well encrypted, and this is the reason behind digital fraud and theft. Virtual credit cards on the other hand unlike normal credit cards use an app to generate a unique credit card number, better for every single transaction. This token is sent to the bank to confirm the transaction, once used for a transaction this cannot be reused therefore eliminating the risk of fraud and digital theft.

What are the perks of a Virtual Credit Card?

One of the key benefits of a virtual credit card in India is the ability to close a Virtual Credit Account In the case of normal credit there is a chance that your personal information might get compromised if there is a data breach that can be an issue in recurring payments.

Even if you close a virtual credit card it eliminates the risk of your original credit card being exposed. Not just, by using your virtual credit card you save your precious time tracking and noting down recurring payments without having a fear of data breach.

What are the limitations of Virtual Credit Cards?

Returning goods from online e-commerce giants such as Amazon can be a great challenge for a virtual credit card. You might be required to swipe or tap the card to initiate the exchange process, which is technically not possible with a virtual credit card in India. This may lead to accepting a gift card instead of getting the cashback for the transaction.

7 Best Virtual Credit Cards in India

As there are multiple benefits associated with Virtual Cards. Here are the 7 best Virtual credit cards in India.

HDFC NetSafe Virtual Credit Card

The Country’s largest credit card provider is well known for offering virtual credit cards for its elite customers. It is a complimentary card that can be only used for one transaction at a time. The card limit is determined by the amount that you load on your credit card. The current validity of this card is 48 hours and the balance left over is sent back to the source (Bank Account). The cardholder is however permitted to have 5 virtual credit cards per day. The retailer who accepts VISA and Mastercard will accept this card.

Also Read- Best Credit Card For Domestic Travel in India

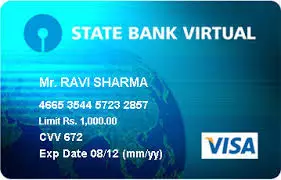

Virtual Credit Card from SBI

The E-card also known as the virtual SBI Credit Card offered by SBI offers you risk-free conducting online business with a retailer. Every Retailer that accepts Visa or Mastercard also accepts Virtual SBI Credit Card too. This card is valid for at least two days otherwise it will be canceled. You can create SBI Virtual Credit Card as it only requires Internet Banking only.

Read- Best Credit Card for Rewards Points India

Virtual Credit Card from Ecopayz

Ecopayz is a digital credit card supported by the Mastercard payment gateway. If you want a trustable and secure virtual credit card then you can go with this for sure. The Ecopayz Virtual credit card is offered in 8 different currencies.

It provides a global service, anywhere that MasterCard is accepted, users can use the funds. Since all the credit card information is blocked once it is used and the card can’t be stolen or misplaced. And you can get this virtual credit card free of cost.

Read- Best Credit Card for Movie Ticket

ICCI Bank Virtual Credit Card

The virtual credit card from ICICI Bank is an electronic payment card that is used to make all online purchases. When it comes to issues, physical cards are used to issue the e-card. It is quite a safe and secure digital card. The use of this card is quite simple and it is of absolutely no charge. This virtual credit card allows you to conduct international transactions and it is one of the top national credit cards

Read- Best Credit Card for College Students in India

Axis Bank Freecharge Plus Credit Card

The Axis Bank Freecharge can be used digitally or physically. There is no enrolment charge for the virtual card. On the same card, users can leverage the features of virtual and physical credit cards. Get the only card if you use Freecharge. The Freecharge app allows users to create an Axis Bank Freecharge Plus Credit Card.

The virtual card provides users to collect EDGE reward points. Axis Bank offers loyalty Points, which are known as EDGE points when customers reach certain milestones. On purchases above $5,000, the card offers 500 reward points.

Check Now- Best Credit Card for Airport Lounge Access

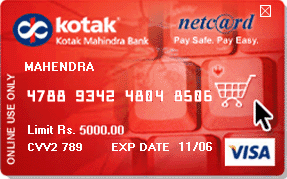

Kotak Netcard

One of Kotak Mahindra’s top virtual credit cards in India is Kotak Netcard. The card has only two expiry dates and is only intended for use at a time. Through net banking, users can put money onto the card. The Kotak Netcard is welcomed everywhere.

This can be used to access platforms’ free trials. The Kotak Net Card is accepted by every retailer online that accepts VISA cards. It is one of the best virtual credit cards in India.

There is no charge for the creation of this card. The bank gives users an excellent opportunity to have a credit card with a Zero balance account but for that, they need to finish the KYC procedure. Using their Aadhar and Pan Cards, they can generate credit card numbers for use.

Read – Best Credit Card For International Travel India

Digipurse Wallet from Union Bank

Another excellent virtual Visa Card offered by Union Bank for both international and domestic transactions. The capacity to generate and create virtual credit cards using any debit card or net banking is Digipurse Wallet’s primary feature. No matter if you have an account is not required to create a Union Bank Virtual Card.

This card can be used even for overseas entrances, where using a physical credit card is challenging due to the limited 3D code.

Check–

Conclusion

These are the top Virtual Credit cards in India listed above. This article would be for individuals looking for the best prepaid or virtual card provider. We hope this article for informational too.

Stay tuned for more.